charitable gift annuity canada

Is a Humane Society gift annuity the right choice for you. As with any other.

Cga Archives Gordon Fischer Law Firm

That is a portion may.

. Annuities are often complex retirement investment products. A charitable gift annuity is a compelling way to make a gift to Diabetes Canada and receive guaranteed income for life. Learn More About Annuities.

Describing what the gift annuity accomplishes. Ad Make A Charitable Donation Today. Tax advantages all or most of.

At the end of life the remainder of your annuity capital becomes a gift for your favourite charities. Help Lift Families Out Of Poverty. Attractive payment rates for life.

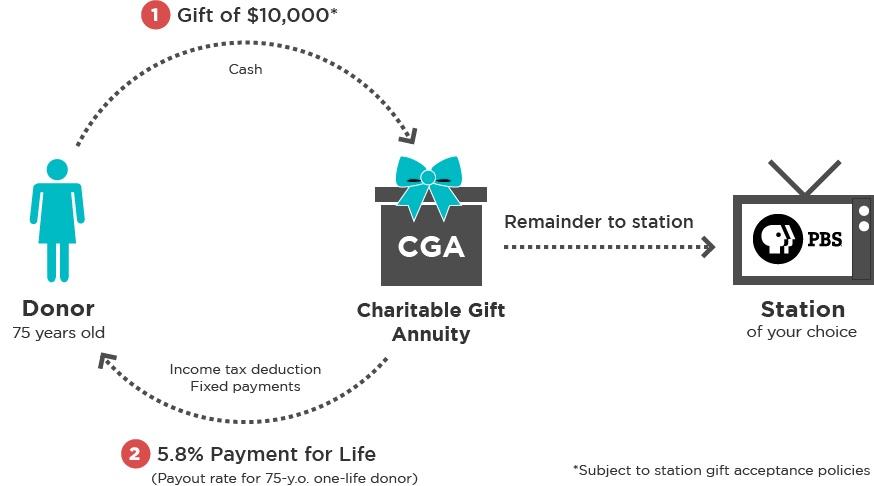

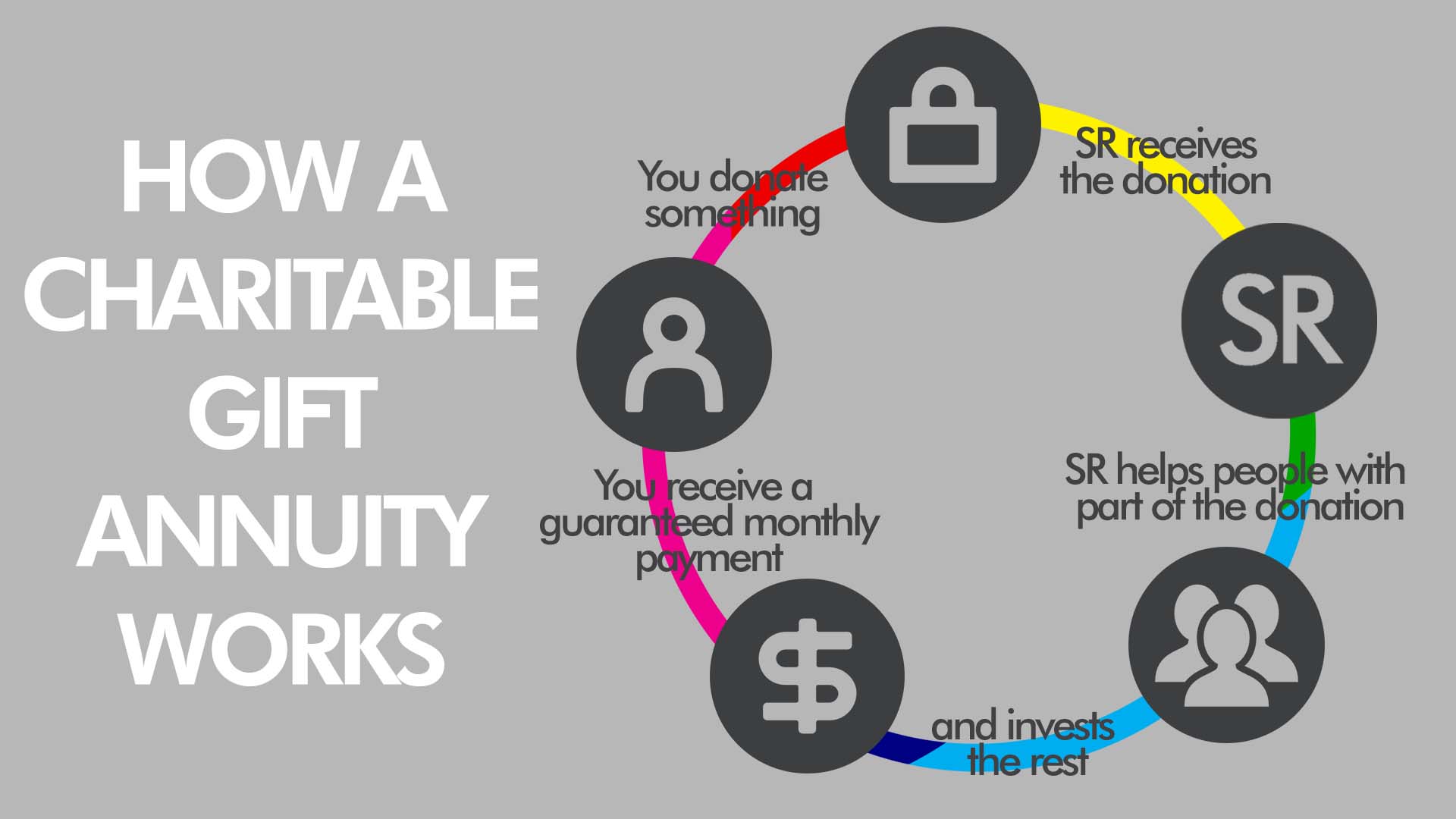

They allow you to give immediate support to Golf Canada Foundation while ensuring a secure income stream for your lifetime. Is a Humane Society gift annuity the right choice for you. A charitable gift annuity is an arrangement under which a donor transfers a lump sum to a charity in exchange for fixed guaranteed payments for the life of the donor andor another person or.

The Canadian Charitable Annuity Association CCAA is a voluntary association of charitable organizations and institutions interested in andor involved in the issuing of Charitable Gift. The life annuity provides a return. A Charitable Gift Annuity is a gift vehicle and when combined with a Gift Funds Canada Donor Advised Fund enables a donor to make a charitable gift during their lifetime.

Guaranteed income for the rest of your life. It is a thoughtful gift that gives back. The platform offers complete donation management tracking and integration.

Create a Legacy with aCharitable Gift Annuity. A Charitable Gift Annuity is a gift vehicle and when combined with a Gift Funds Canada Donor Advised Fund enables a donor to make a charitable gift during their lifetime without. Ad Learn About Charitable Trends Behaviors and Priorities of High Net Worth Americans.

Additionally you will receive a charitable tax receipt for the. To learn how a Charitable Gift Annuity or other planned gift can leave a lasting legacy please contact us. Charitable Gift Annuity.

Ad Support our mission while your HSUS charitable gift annuity earns you income. Learn some startling facts. An income stream for the donors lifetime.

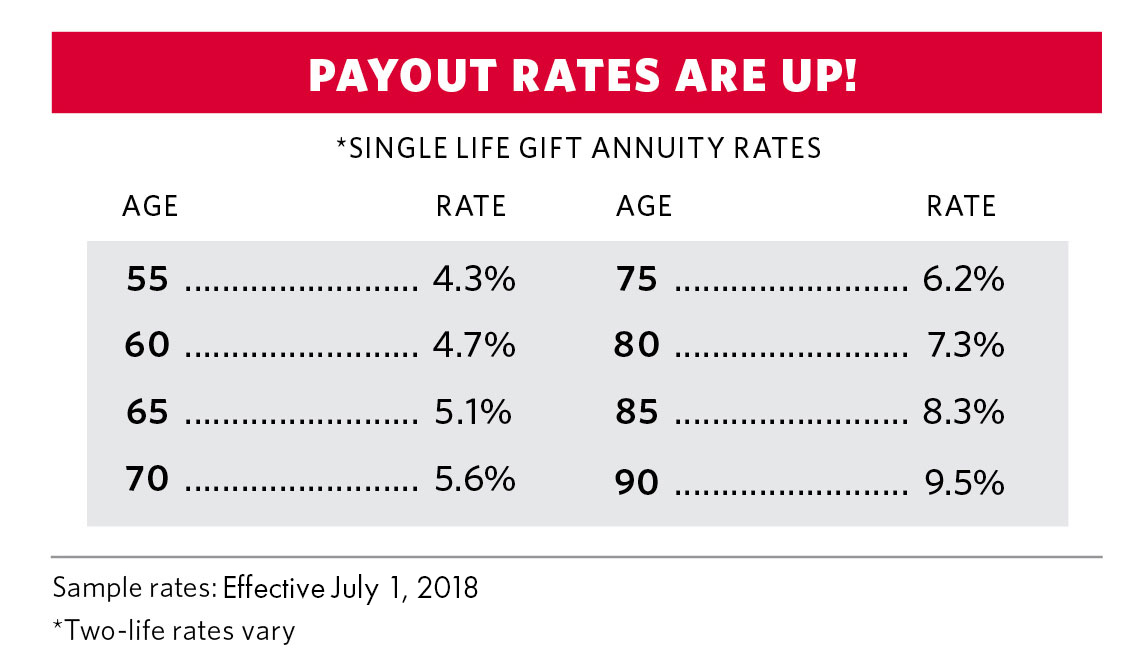

Ad Get this must-read guide if you are considering investing in annuities. Ad Get Access to the Largest Online Library of Legal Forms for Any State. The charitable gift annuity is a popular planned giving instrument for elder Canadians as it allows a person to make a significant contribution.

Bank of America Private Bank Is Here to Help with Your Philanthropic Goals. It has two parts. A charitable gift annuity to benefit the Catholic organization s of your choice is a generous expression of your support for the Catholic.

Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo. Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments. An immediate partial tax deduction based on donor life.

Ad Support our mission while your HSUS charitable gift annuity earns you income. There are of course other benefits to charitable gift annuities including. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity.

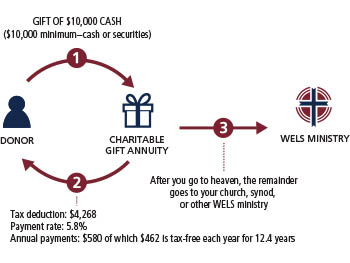

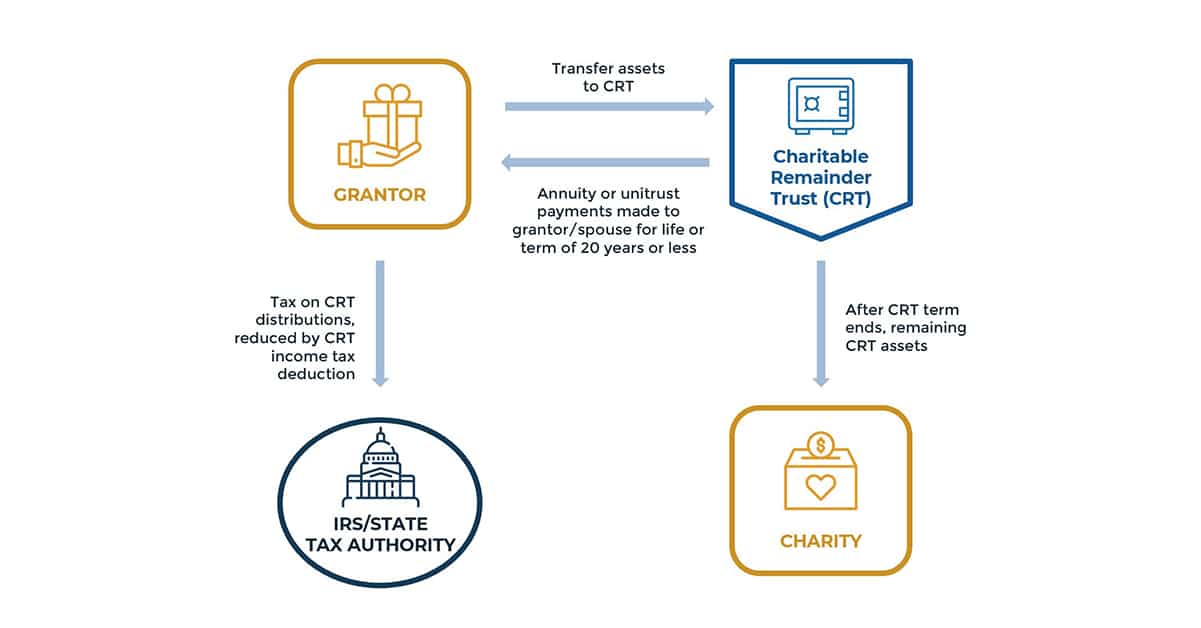

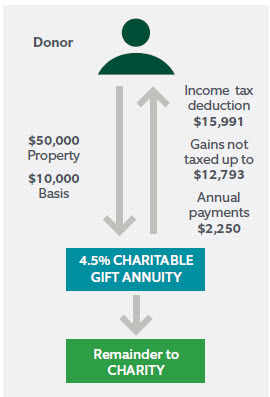

A charitable gift annuity is an arrangement under which a donor transfers capital to a charitable organization in exchange for immediate guaranteed payments for life at a specified rate. Or call the Stewardship Planned Giving department 1-800-619-7301. A charitable gift annuity allows you to eliminate capital gains tax when you donate long-term appreciated assets including non-income-producing property.

Charitable Gift Annuities CGAs work the same way as regular commercial annuities but offer even more advantages because of a charitys tax-free status. A charitable gift annuity or Gift Plus Annuity is an attractive way for individuals aged 70 years and older to make a donation to Arthritis Society Canada while. Charitable Annuity Example 1.

Ad Givelify is the most widely-used charitable giving platform for nonprofits. Let us help you get started. Of the 100000 you provide to the charity about 52000 is used to buy the annuity from a tier-one life insurance company.

Ad Fixed Payments Eliminate The Impact Of Market Volatility. Charitable Gift Annuities will give you many benefits. Charitable Gift Annuities will give you many benefits.

Charitable Annuity Benefits Of A Charity Gift Annuity Link Charity

Charitable Gift Annuities Studentreach

Charitable Donations Structuring Gifts With Passive Retirement Income Advisor S Edge

Charitable Gift Annuities Citadel Foundation

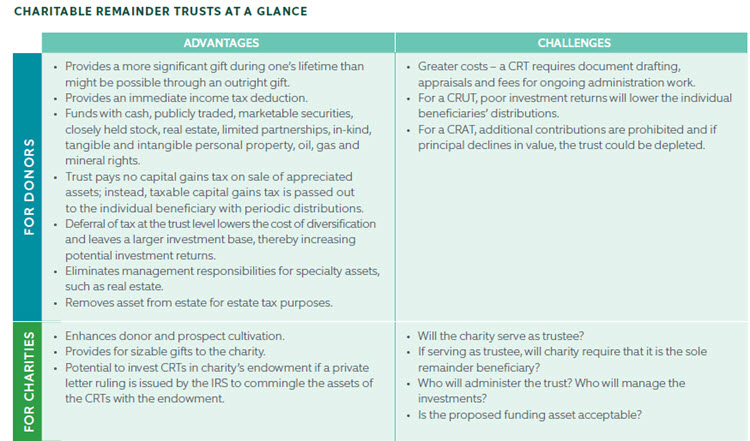

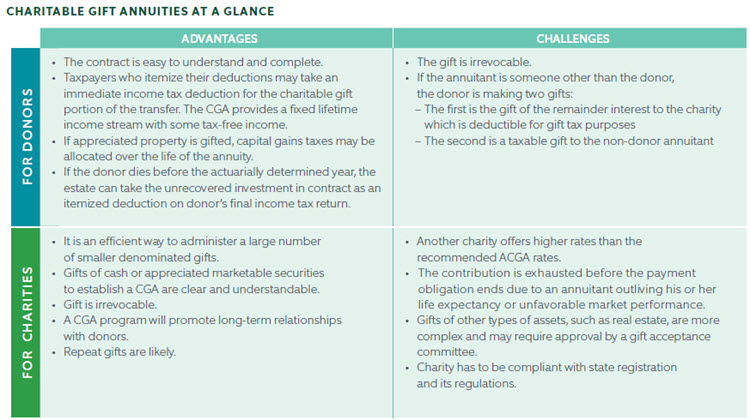

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

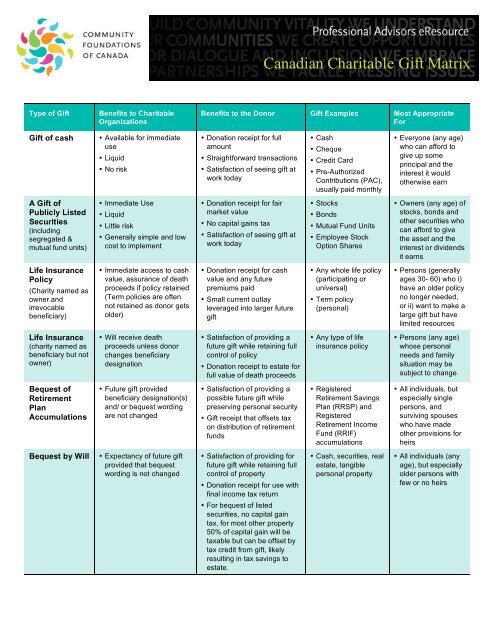

Canadian Charitable Gift Matrix Community Foundations Of Canada

Charitable Gift Annuity Partners In Health

Tax Advantages For Donor Advised Funds Nptrust

Http Www Valamohaniyercharitabletrust Com Annadan Html Free Food Providing Functions Are Every Month Amavasai Trust Words Charitable Charity Organizations

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Gift Annuity The Christian School Foundation

Charitable Remainder Trusts Crts Wealthspire

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust